Your Fire Pit & Home Insurance: Coverage Clarity Now

As you're setting up your fire pit with a cover for another evening of conversation, you might wonder how it affects your homeowners policy fire pit coverage. I remember a backyard movie night where thermal comfort mapping transformed our gathering (lowering the flame, lifting the pit, and adding a subtle screen) turned struggling conversations into effortless connection. That's when I realized comfort is a system: when you tune it, hospitality feels effortless. Today, let's demystify insurance coverage so you can host with confidence, not confusion.

8 Insurance-Ready Fire Pit Strategies for Thoughtful Hosts

1. Understand Your Pit's Coverage Category

Your insurance treats permanent and portable fire features differently. Not sure which type fits your situation? See our portable vs permanent fire pits comparison. Permanent installations (like built-in stone pits) fall under "other structures" coverage, typically capped at 10% of your home's insured value. Let's say your home is insured for $300,000, you would have $30,000 total coverage for all unattached structures (including sheds, gazebos, and your fire feature). Portable pits, meanwhile, reside under personal property coverage. Knowing this distinction helps you calibrate your expectations, and your coverage limits. Small moves, big mood: If your pit represents significant investment, request a schedule of valuable items to ensure adequate protection.

2. Disclose Before You Ignite

Many homeowners unknowingly void potential coverage by not disclosing fire features. Insurance requirements for fire features vary by carrier, but transparency builds trust. Call your agent before installation, especially for permanent setups requiring gas lines or significant construction. This is not bureaucratic red tape; it is creating alignment between your peaceful hosting vision and your policy's reality. A gentle directive: Keep your disclosure conversation factual ('I'm installing a 36-inch natural gas pit 12 feet from my deck'), not defensive.

3. Navigate Liability with Sensory Awareness

Fire pit liability considerations extend beyond your property line. If embers damage a neighbor's fence or someone trips near your gathering space, your liability coverage responds. But here's what most miss: insurance companies evaluate preventable risks. Keep clearances visible (15 feet from structures), maintain unobstructed pathways, and position seating to avoid tripping hazards. These are not just safety steps; they are liability prevention. Notice how wind direction affects smoke flow? That same awareness helps you anticipate potential risk points before they become claims.

4. Match Safety Practices to Coverage Realities

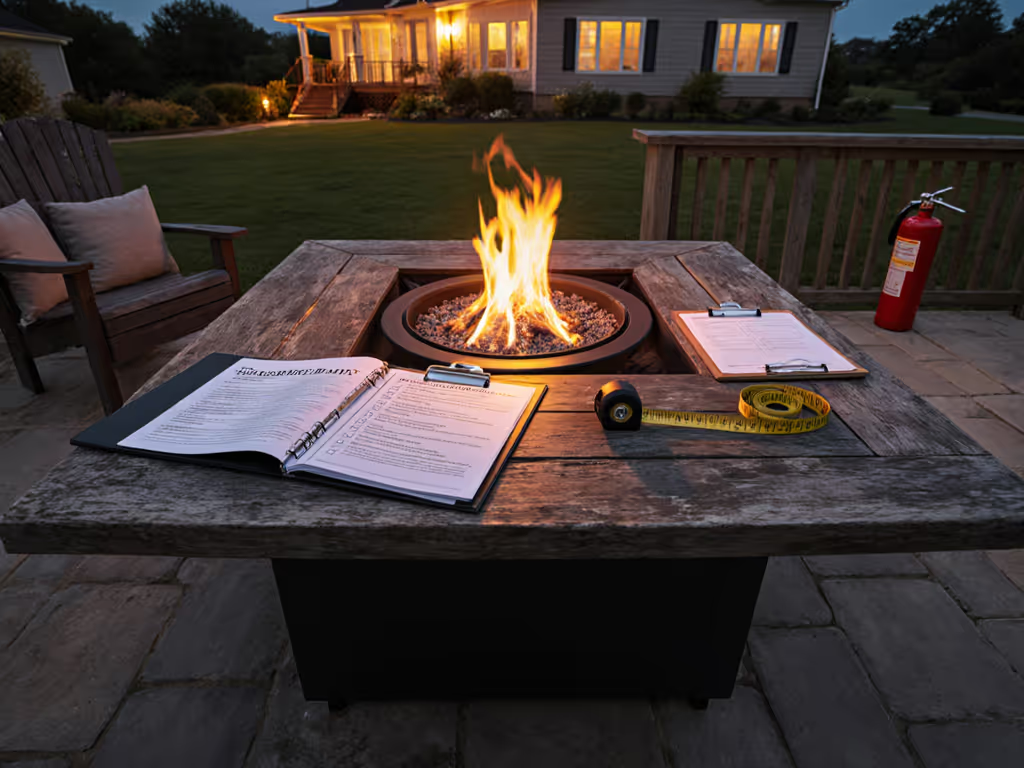

Your homeowners policy fire pit coverage typically excludes negligence. This means documented safety practices become your insurance portfolio's quiet companion. Always use a spark screen (it's a visual cue that says 'I'm mindful'), keep a fire extinguisher within arm's reach (not buried in the shed), and extinguish completely before bed. These stepwise tweaks create verifiable safety habits that insurers recognize. When documenting your setup for your agent, mention these practices, as they demonstrate risk management in action.

5. Document Your Compliance

Insurance requirements for fire features often tie to local codes. For state-by-state rules and HOA considerations, see our fire pit regulations guide. Municipalities increasingly regulate pit size, height, fuel type, and placement, especially in dense neighborhoods. Keep your permit documentation, HOA approval letters, and receipts for safety accessories in one digital folder. This creates a compliance trail that strengthens your position should questions arise. Think of it as your hosting "paper trail of peace of mind," a quiet-host ethos that proves you're not cutting corners.

6. Optimize Your Pit's Protective Features

A well-chosen fire pit with a cover does double duty: protecting your investment from weather and demonstrating care to insurers. When shopping, prioritize features that align with fire pit risk management: tempered glass wind guards, auto-shutoff timers for gas models, and built-in ember containment. For side-by-side picks and pricing, check our fire pit accessories comparison. These are not just comfort upgrades; they are risk reducers that may positively influence your premium assessment. Your cover is not just seasonal storage, it is a visible commitment to safety that insurers notice.

7. Calibrate Heat Zones Mindfully

Remember my movie night realization? Comfort is calibrated: distance, height, flame, and mindful hosting. Position your pit to create natural conversation zones while maintaining safety clearances. This spatial awareness reduces liability risks (no one scrambling to adjust seating near open flames) and creates predictable heat patterns that guests can navigate safely. Measure your fire's "comfort radius" in different wind conditions, and use that data to position seating optimally while staying within insurance-mandated clearances.

8. Review Liability Limits Annually

Property insurance for outdoor features like fire pits requires periodic coverage checks. If your pit represents significant investment or you host regularly, consider umbrella liability coverage. Standard policies often cap liability at $100,000 to $300,000, a potential shortfall if serious injury occurs. An annual review with your agent ensures your liability limits match your hosting reality. Ask specifically: 'Does my current coverage reflect the safety features of my fire feature and my hosting frequency?'

Comfort is calibrated: distance, height, flame, and mindful hosting.

Your Action Plan for Insurance Peace of Mind

Now that you've navigated these eight clarity points, take one concrete step this week: Schedule that 10-minute call with your insurance agent. Bring your pit's specifications (size, fuel type, placement relative to structures), photos of safety features (spark screen, cover), and any permits. Frame it as partnership: 'I want to ensure my setup aligns with coverage requirements so I can host responsibly.'

This is not about fear, it is about the freedom that comes from knowing your cozy gatherings are protected. When you manage fire pit risk with the same thoughtfulness you apply to seating arrangements and wind direction, you create spaces where conversation flows as easily as the warmth. Small moves, big mood: That is the essence of confident, compliant hosting.

Related Articles

Clinical Fire Therapy: Evidence-Based Protocols for Therapists